Does this seem fair to you?

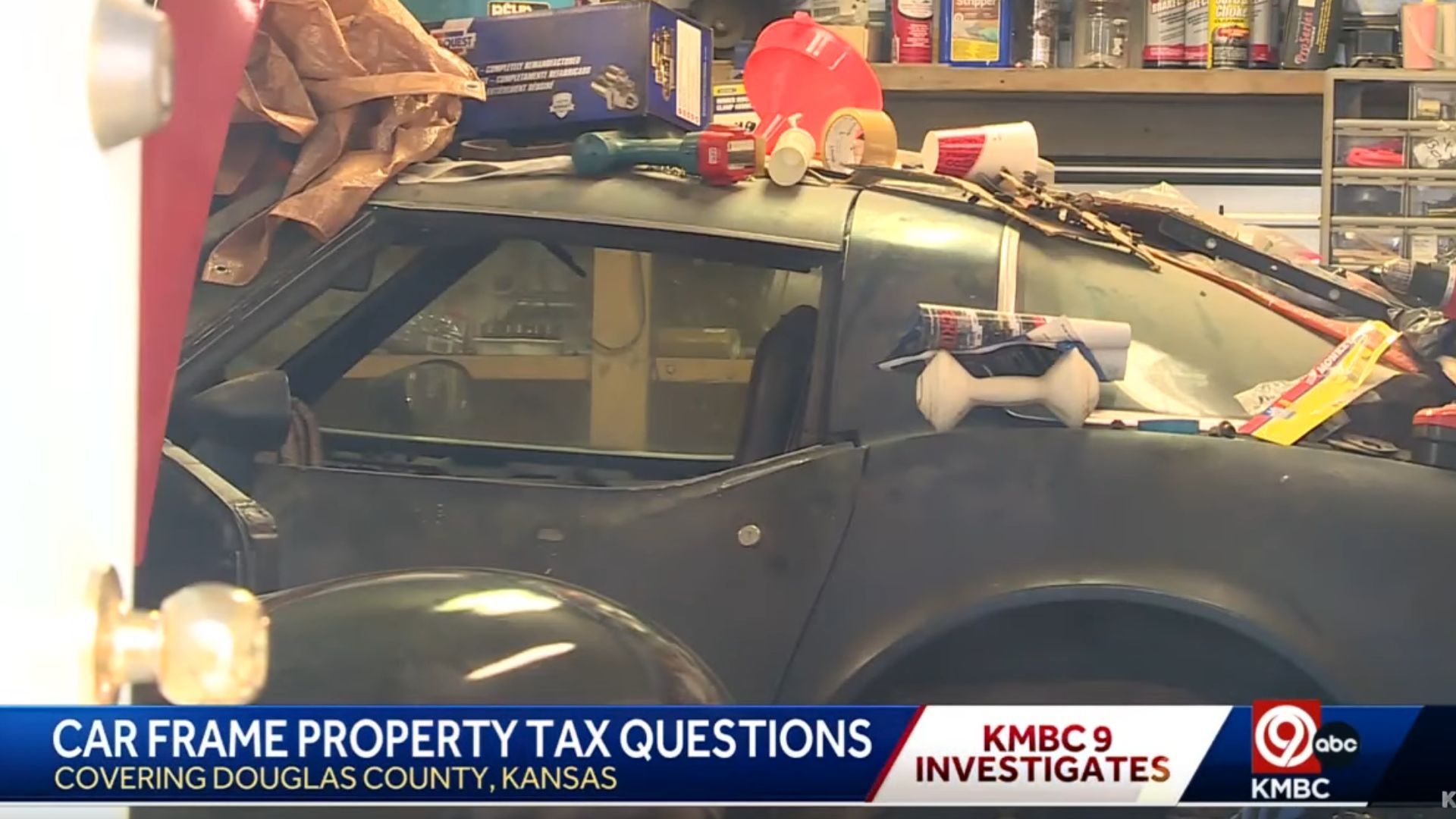

Imagine buying a rolling chassis for parts only for the government to tax you heavily on that acquisition every year. That’s exactly the situation a Kansas man is facing with a 1979 Chevy Corvette chassis officials from Douglas County, Kansas claim is valued at $12,100. Don Hawley, the owner of the parts car, says he bought it for a mere $1,000 and believes that’s what it’s worth, considering it has no drivetrain, interior, and plenty of other parts.

Check out a classic Chevy that looks like a million dollars here.

Hawley told local news outlet KMBC he received a personal property bill for $718, an amount he thought was “pretty unrealistic for a car frame.” What’s more, the man claims Douglas County appraised the value at $1,000 for 2021. What’s more, KMBC searched county records and found Hawley has paid at maximum $61 in taxes for the ’79 Corvette, calling into question the sudden spike in the county’s valuation.

A statement from a Douglas County representative was sent to KMBC:

"The Douglas County Appraiser’s Office sent a Notice of Value Change in May 2022 to all Douglas County residents who own personal property, including Mr. Hawley."

"Mr. Hawley contacted the Douglas County Appraiser’s Office on Nov. 30, when staff provided instructions about how to complete the Payment Under Protest process. Taxpayers may appeal or “protest” the valuation or assessment of their property if all or part of the tax is paid prior to Dec. 20 by submitting a Payment Under Protest application with the Douglas County Treasurer’s Office on or before Dec. 20. After the Dec. 20 deadline, all protest forms must be filed at the time taxes are paid."

"The Appraiser’s Office is willing to review the valuation, but there is a state-mandated procedure that must be followed as well as needing some additional documentation as to the condition of the vehicle. As of today (Dec. 29), the Appraiser’s Office has not received any of this documentation. To date, a Payment Under Protest application has not been filed with the Douglas County Treasurers Office."

"In 2022, the Appraiser’s Office used the state’s prescribed method of valuation which was found in the JD Power-NADA guide (National Automobile Dealers Association). The NADA is the preferred method of valuation. In the absence of a NADA value, the actual purchase price is relied upon. Prior to the 2022 valuation, the customer’s purchase price was used as the value due to the fact that staff were not able to locate a value in the NADA guides. Additionally, the customer did not file the 2022 Personal Property rendition form, adding additional penalties to the account."

Hawley told KMBC he would go through the appeal process, claiming he wasn’t notified of the deadline. He also reiterated that he thinks the Corvette’s valuation is far too high.

This certainly isn’t the first time a car enthusiast has been targeted for government fleecing. Even if you choose a more affordable vehicle, some seem to think you’re an inexhaustible source of revenue. Do you think that’s the case with Hawley or is there more to the story?

Source and images: KMBC