There’s plenty of disagreement about where we are and what to expect next…

You likely have been hearing conflicting news about the global chip shortage and how it’s affecting the auto industry. There are plenty of news sources repeating what Ford CEO Jim Farley said a couple of weeks ago, that the shortage is waning and will be over by the beginning of next year. That talking point has been repeated by the U.S. Department of Commerce. However, Intel CEO Pat Gelsinger rained on that parade, declaring the chip shortage is going to last another two years.

Check out the Motorious Podcast on YouTube, Spotify, Apple Podcasts, and other podcast platforms.

If Gelsinger is right and Farley is wrong, that means the shortage will last through 2024. Considering that for May of this year, US car sales were down 21 percent year-over-year, even though consumer demand is still strong, it would seem a recovery could very well be a long way off. New car prices are also continuing their upward trend, with many shoppers paying well over sticker.

In an interview at Davos during the recent World Economic Forum Annual Meeting, Gelsinger cited equipment shortages for the company’s new production facilities as being a choke point in the process. He also touched on how ramping up domestic semiconductor production isn’t an overnight process, reinforcing the fact a solution is going to take time.

Pretty much everyone agrees the semiconductor fiasco we’re facing today began as the result of pandemic mitigation measures. Manufacturing facilities were scaled back or even shut down as many treated covid as a civilization-ending condition. When consumer demand for automobiles bounced back much sooner than many in the industry were expecting, the supply chain couldn’t handle the strain. That meant fewer new cars being made, the cost of old cars skyrocketing, and plenty more market weirdness.

While automakers are pushing increasingly advanced onboard tech in new cars, not to mention promoting electrification as the next big thing, there’s little discussion about what these innovations require when it comes to semiconductors. The demand for chips in the automotive market is increasing steeply. That demand is on a collision course with the brutal reality that Russia’s military actions are throwing global supply chains into chaos, especially when it comes to neon.

The global supply of neon has been kinked as a result of the Russian invasion. Ukraine’s two neon-refining facilities have been responsible for about half of neon used in the world. Both facilities stopped production as the Russian invasion kicked off and have become part of the collateral damage of the war.

Neon is essential to control lasers which etch semiconductor chips. Eventually, the decreased supply is going to have serious ramifications for chip production, so the chip shortage problems we’ve been experiencing since the pandemic shutdowns could conceivably worsen if something isn’t done.

Just how long the currently supply of neon gas will last is an item of great debate. Some think it’s already pretty much depleted. Others argue we have at least a few more months. But the production of neon typically happens at steel plants since it uses some of the same processes and technologies, so it isn’t a natural resource only found in Ukraine. After Russia invaded Crimea, some US steel plants adjusted their air separation so they could capture neon. Other countries began taking similar steps. Before those changes, Ukraine was responsible for about 70 percent of the global neon supply.

China is another big neon producer, with several companies in the communist country churning out semiconductor-grade purified gas. Starting in December of last year, Chinese neon prices began climbing rapidly as anticipation of the Russian onslaught heightened. Here in the US, the White House even told semiconductor companies to start looking for new sources of neon since the supply from Ukraine would likely be disrupted.

It’s possible facilities have adjusted laser settings to help neon gases last longer. There’s also a process for recycling neon. Since the industry is notoriously secretive about their practices, we know precious little about what’s actually happening.

A real question is whether too much emphasis is being placed on the neon shortage as a way to cast the Ukraine-Russia war in a certain light? While that’s certainly possible, even as the world moves to pick up the slack in the neon supply, the Russian invasion poses other threats to the semiconductor industry. Russia has been a huge supplier of materials needed to produce chips, like palladium, nickel, and C4F6. Military conflict can absolutely throw global supply chains into disarray, especially when heavily industrialized nations are involved.

Even with the difficulties, Gelsinger put a positive spin on the impact of inflation on Intel’s business. While he said the commercial end is doing just fine, with fewer individuals demanding chips he sees an opportunity to play catchup and hopefully cure some of the supply chain woes. However, there is a risk inflation could wreak havoc instead of becoming a positive for the chip shortage situation.

With competing narratives about what’s happening with the global semiconductor chip supply and when the crisis will end, it’s difficult to know what’s coming next.

Sources: VOX EU, R&D World, Reuters, Associated Press, Ford Authority, Yahoo Finance

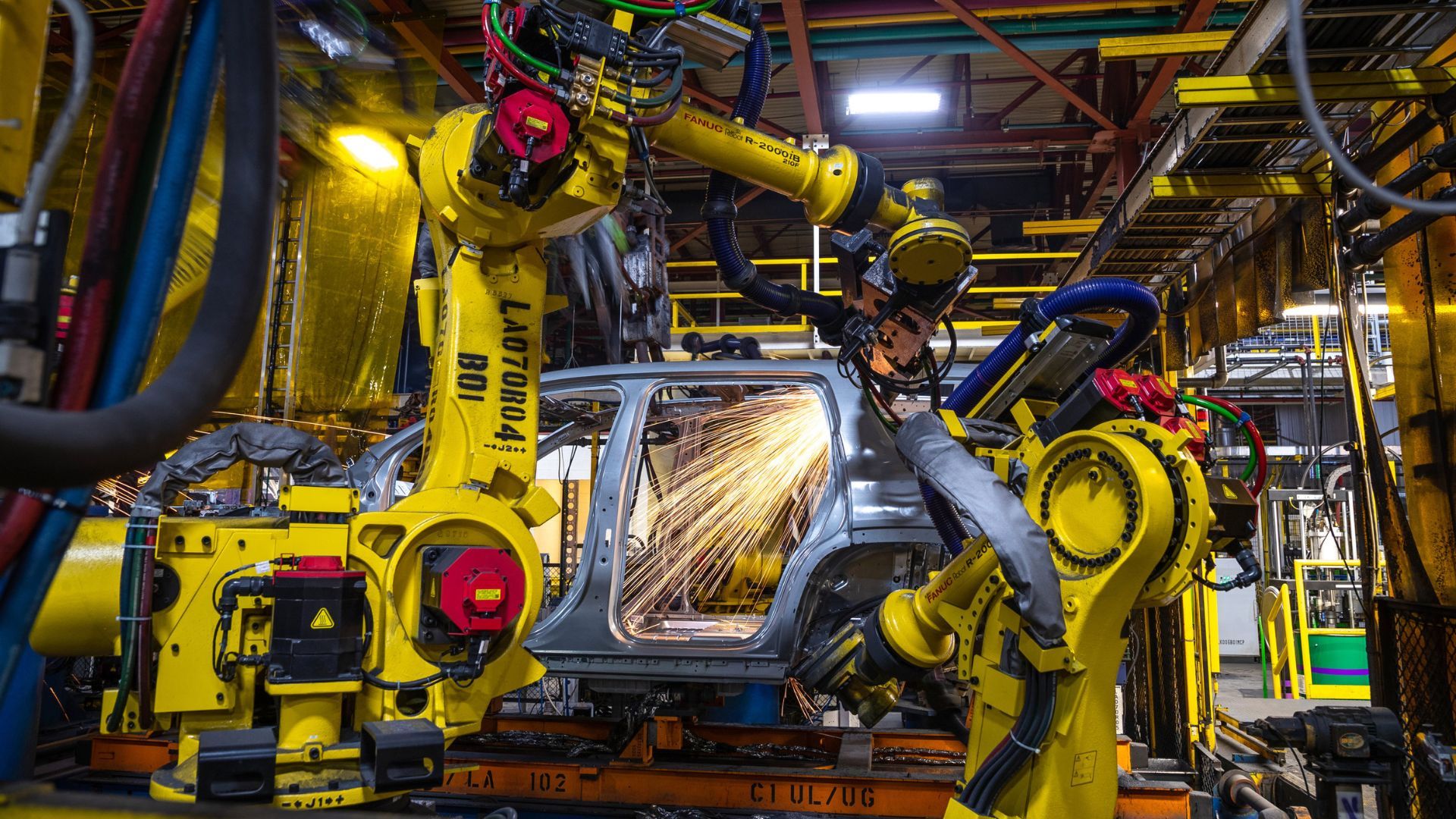

Photos via Intel, GM, Ford, Stellantis